Friends of Pacific Spirit:

We have noticed that there has been a heightened level of concern amongst you, our valued clients, about the state of the markets. This anxiousness started when the September 2021 statements, which reflected September’s equity market decline, were delivered to your home. Your concern abated slightly as markets recovered through the end of 2021, but began again with Putin’s war, inflation, and higher interest rates. This anxiety is to be expected given the turmoil in the world and the focus of the press – bad news sells. It is fine to feel the anxiety, but you should not act on that feeling, because financial decisions made emotionally are prone to error.

The two biggest drivers of stock prices are earnings and interest rates. Both are presently favourable to stock prices. Last year, companies collectively set a record for earnings. It is expected that they will do so again this year, and also again in 2023. Standard & Poor’s reports the following earnings for the S&P 500 index (the 500 largest companies in the USA):

Year Earnings

2018 $151.60

2019 $157.12

2020 $122.37 (Covid!)

2021 $208.07

2022E $225.04

2023E $246.22

Note: Figures are as of 03.17.2022 as reported by the Prudent Speculator.

Dividends are also expected to be a record high this year and again next year, continuing their history of growing faster than the rate of inflation over the long-term.

Interest rates are low by historical standards and even though they are rising and will likely continue to rise over the course of this year and into next year, current interest rate projections indicate that interest rates will still remain below historical norms. This is positive for the markets.

The North American economy continues to generate a massive number of new jobs. The unemployment rate is low and is approaching where it was before the pandemic started. The economy is strong.

The financial system is strong. The banking system has been well managed and the banks – US and Canadian – have very ample capital levels. Really bad financial markets are almost always associated with significant problems in the banking system.

Commodity prices are buoyant which is very favourable for the Canadian economy.

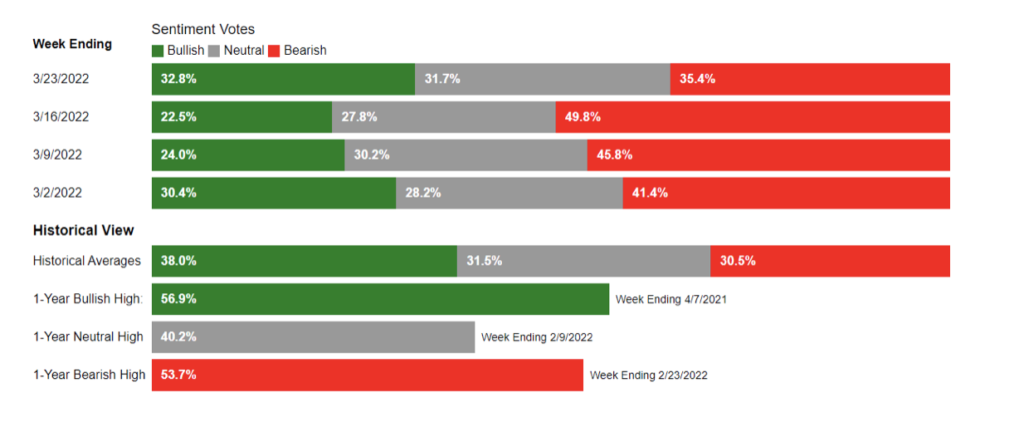

The average retail investor (i.e., the small investor) has been very bearish (i.e., believes the stock market will decline) throughout March – amongst the most bearish they have been in history.

Perversely this is a very strong buy signal. The small investor is almost always wrong at the extremes. When they are very, very negative, as they are now, the market usually proceeds upwards. In a similar fashion when they are very, very optimistic the market tends to underperform.

The companies that we follow and invest in – Quality Growth Companies – are meeting or beating expectations. The recent pull back in the markets has brought some of these companies back into our buy range. For a few this is the first time in years that they have been buys. The market has always recognized the quality of these companies and they have traditionally traded at premium prices. We can now pick them up “on sale”. Dennis will tell you that he hasn’t seen me this excited about market opportunities for a few years.

Historically the market has done well in periods of war. There is almost always an immediate decline, followed by a rise to new higher levels.

Historically the market has done well in periods of inflation. Investing in equities has been amongst the best protections against inflation – besting inflation by 6.6% per year over the long-term.

On average the stock market will decline by 14% at some point in a year. These declines are a regular, but not predictable, occurrence. Year to date the markets are:

Index Performance

S&P 500 The 500 Largest Companies in the US – 5.2%

TSX Composite The Toronto Stock Market + 3.5%

No, that is not a typo, the Canadian market is up 3.5% so far this year. The US market is fairing better than an average year’s pull back.

On the fixed income side, we own a lot of corporate bonds. As the annual reports come in we are very pleased that every one of these companies is doing well – some are doing extremely well. We expect to continue to get our interest payments on time and the principle repaid to us at maturity.

Volatility has again raised its ugly head. From 2010 to the start of the covid crisis we had a long period where the market marched forward almost relentlessly. This period was abnormal in that volatility was very low – an exceptional period. Now that volatility has returned, people aren’t accustomed to it, and it seems abnormally high. But it isn’t, we are just back to normal volatility.

If we may, we would like to re-orient this conversation to a more personal level and talk about your individual portfolio. That is what is most relevant to you.

- We structure your portfolio so that your overall asset mix (equities, fixed income, and cash) reflects your goals, investment time horizon, risk tolerance, risk capacity, tax situation, and the other factors that are unique to you.

- We know that the stock market periodically goes into a funk – unpredictable as to both when the funk will start and how long it will last, so we strive to have cash flowing into the portfolio from sources other than equity sales (i.e., sources such as money market fund redemptions, interest on bonds, dividends, and bond maturities and sales), so that we do not have to sell stocks when their prices are down. That is when you want to buy stocks, not sell them.

- We build your portfolio carefully knowing the vicissitudes of the market; harnessing its long-term growth while insulating your cash draws from the short-term variability of the market.

Although it is tough to do, our recommendation is to tune out the noise and especially tune out the market prognosticators. Exaggerated news with shocking headlines gets attention and prompts mouse clicks and sells papers.

Please feel free to share this post with anyone you feel would benefit from its contents.

John and Dennis

© Pacific Spirit Investment Management Inc. 2022