Dear Friends of Pacific Spirit,

Quarterly Market Update

We trust that all is well with you as summer kicks off in earnest. Today, we are writing to provide you with an overview of some key market developments over the last quarter, and to provide our thoughts on the future.

North American markets surged higher over the quarter, with the S&P 500 Index finishing up over 8% in Q2 and ending June with five straight record closes, and the Canadian S&P/TSX Composite Index ended the quarter up 7.83%, for a fifth straight quarter of gains. The TSX also hit an all-time high during the quarter.

This was the quarter when North America finally began to see signs of a return to normal. Health Canada said all Canadians can be fully vaccinated by the end of September, while as of late June, over 65% of Americans aged 18 and older had received at least one shot. Recovery anticipation brought its own set of challenges, as inflation picked up. Canada’s annual inflation rate accelerated at its quickest pace in a decade, and an increase in the U.S. consumer price index, global home prices and global food costs added to these worries. While the Bank of Canada (BOC) said it expects to hit its inflation target a year early, which could mean a rate increase next year, The U.S. Federal Reserve (the Fed) continued to describe most of the current inflationary factors as likely temporary. Regardless, both central banks kept their key interest rates unchanged at all-time lows in Q2.

BOC Governor Tiff Macklem said purchases of government debt would be scaled back by a quarter to $3 billion, while Fed Chairman Jerome Powell said that Fed officials had begun discussions about reducing bond purchases. Both central banks released positive views of future growth, with a BOC survey showing that households expect to return to pre-pandemic spending levels within a year, and the Fed stating that “indicators of economic activity and employment have strengthened” and that they expect “very strong” economic growth in the latter half of 2021. Macklem indicated that the continued appreciation of the Canadian dollar “could have a material impact on our outlook and it’s something we’d have to take into account in our setting of monetary policy.”

Vaccines vs. the Virus

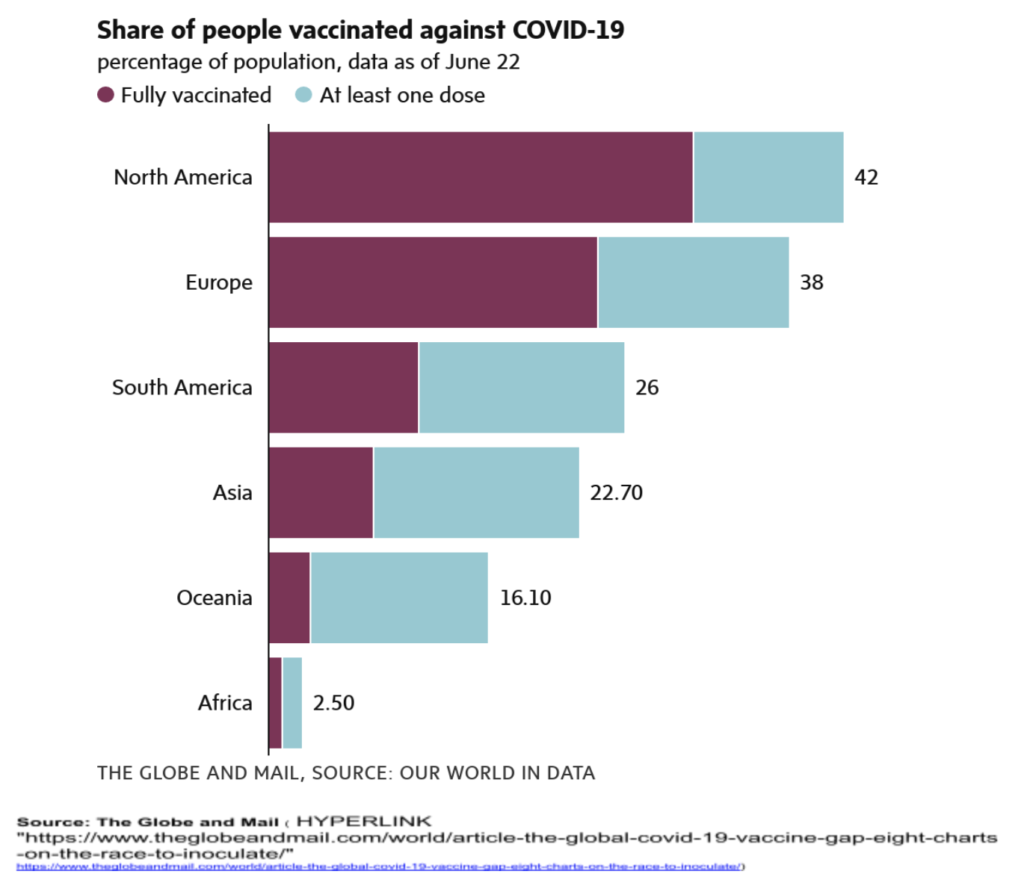

While North Americans have become increasingly optimistic about the pace of vaccine rollouts, it’s important to note that there is still much work to be done worldwide before we can expect a return to a way of life approximating normal, both as a society and economically. We’ve included the chart below to demonstrate the progress of vaccination programmes internationally.

North America leads the way, which recent optimism reflects. In fact, Canadian consumer sentiment hit its highest levels since 2009 this quarter. Yet the challenges in various countries around the world were substantial. Worldwide deaths from the pandemic topped three million. India dealt with a massive outbreak that saw over 200,000 cases in one day, a new high, and at one point the country accounted for 46% of global cases. The B.1.617 variant first identified in that country was named by the World Health Organization (WHO) as a variant of concern, and it has now begun spreading internationally. The relaxation of restrictions in England was delayed by four weeks because of the spread of this variant, and German Chancellor Angela Merkel warned Europe is “on thin ice” in its battle against it.

Countries and organizations continued to adapt, and in the last three months, we saw increased vaccine deliveries, progress in approvals for children as young as 12 to be safely inoculated, approval of new vaccines, large declines in deaths and hospitalizations, more re-openings and a global focus on sharing doses with those countries whose programmes are struggling. Existing vaccines are even testing well against new variants. Despite hiccups, including a replacement of Canada’s head of vaccine distribution, things were still looking positive on the home front. Prime Minister Justin Trudeau expressed optimism for a “one-dose summer” with loosened restrictions, Canada will no longer require fully vaccinated air travellers to quarantine upon arrival, and travel restrictions were loosened in many parts of the world. Both the Public Health Agency of Canada and the US Center for Disease Control (CDC) say people who are fully vaccinated against COVID-19 can begin to do things like have dinner together inside a private home without having to keep their distance or wear a mask. We caution, however, that the war on Covid is still far from over.

Economic News

Turning to the economy, oil hit its highest price levels in more than two years. The Canadian government ran a deficit of $268.2 billion through the first 10 months of its fiscal year as it battled the pandemic. Finance Minister Chrystia Freeland unveiled a new federal budget, including $101.4 billion in new spending over three years to assist with the recovery from the pandemic and transition the country to a green economy. The deficit targets are $354.2 billion in 2020-21, $154.7 billion in 2021-22 and $30.7 billion by 2025-26. Despite this, S&P Global Ratings maintained its AAA rating for Canada, and the International Monetary Fund (IMF) upgraded its view of Canada’s economic growth this year by the most among all advanced economies, expecting it to grow 5%. In a sign that the effects of the pandemic are still not behind us, the Canadian unemployment rate rose to 8.2% as the country battled the virus’ third wave.

Despite the challenges of the virus and other events, including a ship trapped in the Suez Canal that cost the global economy tens of billions of dollars, there was an abundance of positive news including the U.S. making progress on a $1 trillion infrastructure spending bill and continued falling jobless claims. The IMF also said it expects global economic output to advance 6% in 2021, and 4.4% in 2022, while the World Bank said it expects the strongest post-recession global growth in 80 years.

Geopolitical Tensions

This quarter, Canada and the U.S.’s disputes over dairy quotas and softwood lumber continued. Relations between the U.S. and China also vacillated as competition between the two increased. The U.S. also engaged in verbal battles with North Korea and Iran, which resulted in warnings of an “acute and unstable situation” on the Korean Peninsula from the former and the firing of two warning shots at armed Iranian speedboats in the case of the latter. President Biden also met with Russian President Vladimir Putin in an attempt to find common ground on several issues. Israel and Hamas agreed to a ceasefire after 11 days of violent fighting.

A Look Ahead

We can’t accurately predict market behaviour in the short term, however, it is very encouraging to see North America slowly begin to return to normal, and other regions begin to follow suit. Suggesting that the pandemic and its ramifications are behind us, however, would be short-sighted; until all nations have emerged from the pandemic, no nation will be truly able to put it behind them. We have seen the difficulties that come with the spread of new variants of the virus, which continue to evolve in regions lacking high rates of vaccination.

We continue to expect that interest rates will remain low, and the equity markets will continue to be richly valued. We do expect volatility to return to the markets – they have been exceptionally quiet when you consider that the average intra-year decline in the S&P 500 index is 14.3%. Given the liquidity in the system, we do not foresee a bear market setback in 2021. We don’t believe anyone predicted the course of the markets over the past 18 months, and yet here we stand at all-time highs on major market indices.

This is precisely why believing and sticking to your long-term plan is imperative. What we can control is constructing and sticking to a plan that is tested for these uncertainties and designed to navigate them without needing to make short- or medium-term predictions, which are often wrong.

Most economic and geopolitical news continues to be positive. As more of the world begins to focus beyond the recovery and back to matters of building their economies there will be increasing opportunities.

An Update on the Lost Seahorse

Pacific Spirit is pleased to be the lead sponsor of the film, The Lost Seahorse, produced by a group of very talented 4th-year Film students at Ryerson University.

The film will have its world premiere at the Ryerson University Film Festival (RUFF) July 16th to 18th. The Festival will be entirely online this year. Information will be available at https://www.ryersonuniversityfilmfestival.com . We understand that the film has also been submitted to the major Film Festivals in Toronto (TIFF), Vancouver (VIFF) and Calgary (CIFF). A film that is accepted for viewing at two of these Festivals is eligible for awards at the Canadian Screen Awards. That would be quite the accomplishment for a student-made film!

We are available to discuss your investment plans. Have a great summer, and if you have any questions, please contact us at (604) 687-0123.

Sincerely,

PACIFIC SPIRIT INVESTMENT MANAGEMENT INC.

Please feel free to forward this commentary to anyone you feel will benefit from it.

© Pacific Spirit Investment Management Inc, 2021