Friends of Pacific Spirit:

We hope that all is well with you and your family. At the conclusion of what can only be described as an intense three months for markets and society as a whole, we are writing to provide you with an overview of some key market developments that took place in the first quarter of 2022, along with some additional thoughts, from both ourselves and others.

The Canadian S&P/TSX Composite Index moved higher over the quarter, finishing up 3.14%. Both the S&P 500 Index and the Dow Jones Industrial Average, however, finished lower, with the former down 4.9% and the latter down 4.6%.

While many of the main subjects at the forefront in Q1 were familiar (inflation and the economic effects of COVID-19, specifically), Russia’s ongoing attack on Ukraine dominated the news in late February and March.

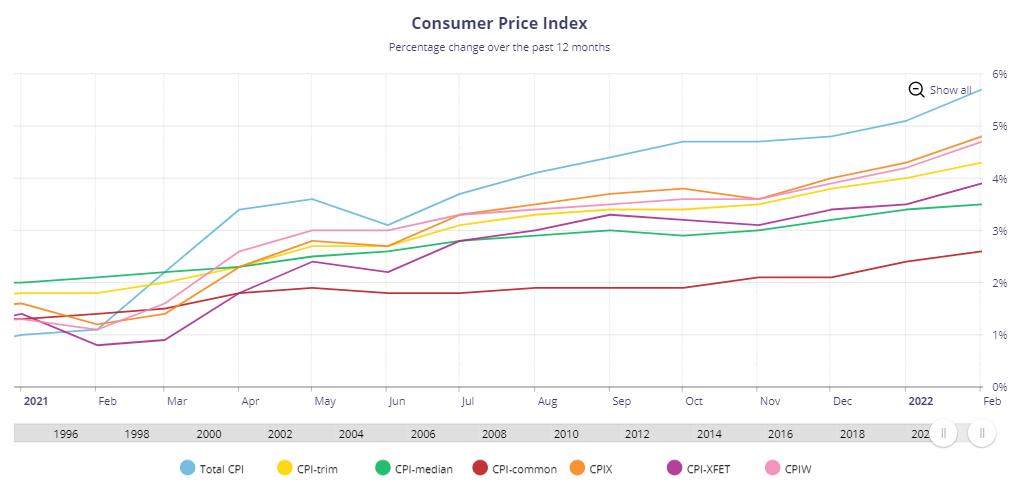

Inflation

After months debating whether inflation was considered “transitory” or “persistent,” the data in Q1 seemed to steer that debate clearly in the direction of the latter. Global food prices jumped to a record high and are expected to continue to climb following Russia’s invasion of Ukraine. In Canada, February’s inflation rate surged at its fastest since mid-1991. U.S. consumer prices jumped to a 40-year high, with Treasury Secretary Janet Yellen stating, “We’re likely to see another year in which 12-month inflation numbers remain very uncomfortably high” and the European Central Bank boosted its inflation expectations to 5.1%, versus previous expectations of 3.2%.

The Bank of Canada said it expects inflation to remain close to 5% until the middle of this year, then start declining rapidly in the second half as supply chain problems diminish. Regardless, it became clear in Q1 that price increases were running too hot, and central banks moved to reduce their previous support and began raising rates. Bank of Canada Governor Tiff Macklem said three separate factors drove Canada’s inflation rate above 5%: a global shift toward consuming goods and not buying services during the pandemic, broad price increases to everyday items like food and gas that have been fueled in part by logistics disruptions, and the overall imbalance between demand and supply in the Canadian economy.

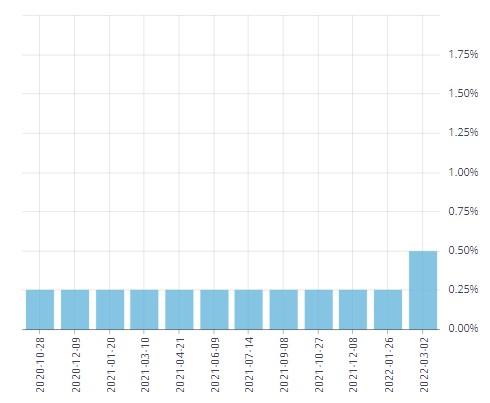

Central Banks and Interest Rates

While the chart above may seem simple enough, it does a good job of visualizing how long rates were kept extremely low by the Bank of Canada before it raised its benchmark interest rate by 25 basis points, to 0.50%, in early March. Tiff Macklem stated, “The economy is now in a place where moving to a more normal setting for interest rates is appropriate.” “The economy can handle it.” Macklem added that “The bank is committed to returning inflation to the 2% target and keeping inflation expectations well anchored.”

In the U.S., the Federal Reserve also hiked rates 0.25% for the first time in more than three years and said it expected six more hikes in 2022.

Yet while the central banks wrestled with taming inflation and easing their economic support, a fresh conflict arose that exacerbated economic troubles: Russia’s invasion of Ukraine.

Ukraine

After Russia invaded Ukraine on February 24, the worldwide response was almost immediate. The assets of Russian President Vladimir Putin, his associates and various Russian oligarchs were frozen. Canada, the U.S., and their European allies cut key Russian banks out of the SWIFT financial messaging system, which daily moves billions of dollars around more than 11,000 banks and other financial institutions around the world. In addition, central bank restrictions were instituted, meant to target access to the more than US$600 billion in reserves that the Kremlin has at its disposal and block Russia’s ability to support the ruble.

Yet it didn’t stop there. Canada and other nations closed their airspace to Russian aircraft operators. G7 nations stripped Russia of its ‘most favoured nation’ status, further isolating the Russian economy. Australia, Britain, Canada, and the United States imposed outright bans on Russian oil purchases, and in an attempt to move European nations away from their reliance on Russian oil, European Commission President Ursula von der Leyen and U.S. President Joe Biden discussed “helping Europe reduce its dependency on Russian gas as quickly as possible.”

“We are right on track now to diversify away from Russian gas and towards our friends’ and partners’ reliable and trustworthy suppliers,” von der Leyen said.

As a result, the U.S. announced on the last day of the quarter that it will release roughly a million barrels of oil a day from its reserves for six months, a release from the Strategic Petroleum Reserve the White House called “unprecedented.”

Aside from the unspeakable human tragedy in Ukraine, the war and the ensuing sanctions exacerbated inflation fears and the potential for central banks to raise rates even quicker than may have been expected just a couple of months ago. The International Monetary Fund stated that the war would have a substantial impact on the global economy, threatening global food security and causing prices to rise.

The war also added another layer of tension to the relationship between China and the USA. U.S. President Biden and China President Xi Jinping met by video conference in mid-March, and Biden “detailed what the implications and consequences would be if China provides material support to Russia” during the invasion. The discussion came amongst reports that China is considering buying or boosting stakes in Russian energy and commodities companies as U.S. & European firms exit, and with the U.S. saying it will more actively pressure China to change trade practices that it believes distort the market.

COVID-19

It’s remarkable, and frankly refreshing after two years, to not have this topic lead off our newsletter. Even though the Omicron BA.2 variant continues to spread, studies were released that demonstrated Omicron has an 80% lower risk of hospitalization than previous variants. So, while China and Hong Kong continued to struggle with additional cases and hospitalizations, closer to home we saw Americans able to go mask-free indoors and the dropping of testing requirements for vaccinated travellers entering Canada. Canada’s Chief Public Health Officer, Dr. Theresa Tam, also said that the number of cases of Omicron in recent months, coupled with Canada’s high vaccination rates, has created good community-level protection against COVID-19.

In Summation

Allow us to offer a more personal observation. These have undoubtedly been the two most shocking and terrifying years for investors since the Global Financial Crisis of 2008-09—first the outbreak of the pandemic, next the bitterly partisan US election, then the pandemic’s second major wave, and most recently a 40-year inflation spike and the war in Ukraine. You might not be human if you haven’t experienced serious doubts about the stability of the world.

There was a lot to give investors pause in Q1, but there was also a lot of positive data along the way. Canada’s unemployment rate neared a record low, with job additions far outpacing expectations. Gross domestic product (GDP) rose for a ninth-straight month with the economy growing at an annual rate of 6.7% in the fourth quarter of 2021. The U.S. economy grew at its fastest pace in nearly 40 years.

What came to matter most was not what the economy or the markets did, but what the investor himself/herself did. If the investor fled the equity market during any of these “crises,” his/her investment results seem unlikely to ever catch up to where they would have been if they stayed the course. If on the other hand he/she kept acting on a long-term plan rather than reacting to current events, positive outcomes followed. It was ever thus, as we expect it always will be.

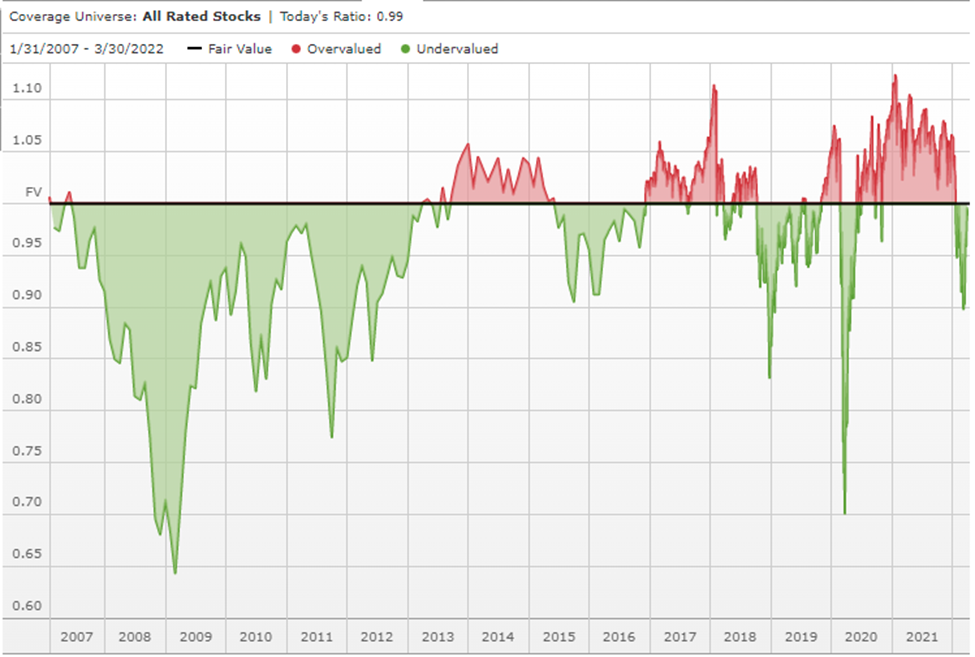

The US market continues to be fairly valued. Morningstar released its Market Fair Valuation report that shows that for the companies in its research universe, the median stock is within 1% of its fair value on March 31, 2022.

It’s important to remind ourselves of such information when we face a barrage of negative news stories or rapid market reactions to events. No matter how dire things may appear on the evening news, at our favourite websites, in the morning paper, or on social media, the top stories of the day are usually a long way away from the fundamental elements that comprise a solid long-term financial plan. Similar to their ability to withstand long-term events like a pandemic, a wise, long-term investor is at an advantage during such hectic times. While so many are suffering from information overload and an inability to process it in a meaningful way, they are able to sit back and focus on their future financial goals. Investing is after all the continuing practice of rationality under uncertainty

We are happy to discuss your investment plans if you feel it would be beneficial. If you have any questions, please contact us at (604) 687-0123.

Pacific Spirit Investment Management Inc.