Pacific Spirit will be celebrating its 20th anniversary in a few days. One of the promises that we made to our early clients, and that we continue to adhere to today, is that we will not inundate you with newsletters or emails. We value your time and will only reach out to you if we have something important to say.

The market has moved up quite strongly since its recession lows in early 2009. It is rare that the market climbs for five straight years without a significant pullback. But does this indicate that the market is overvalued and on the cusp of a major pullback? In our opinion, the market is in a range of “fair valuation”. Morningstar, an independent research firm, says that the market is currently 1% undervalued, which is as close to fair valuation as you can get. Our analysis of the individual companies that we track confirms that stock prices, while no longer inexpensive, are not excessive.

We are not seeing the typical signs of a market top. Normally we would expect to see some or all of the following if we are at a market top:

- Significant stock overvaluations – Morningstar says we are within 1% of fair value so overvaluation does not generally appear to be an issue.

- Over confidence of investors – Everybody is worried, and bull markets climb a wall of worry.

- Declining earnings – Projections are for earnings this year to be 6% to 8% better than in 2013, Earnings for 2015 are expected to be better than 2014.

- Faltering economy – US GDP is growing slowly and steadily. The housing market is recovering. Auto sales are strong. Strong equity markets are giving investors money to buy items. One of our clients has used his market gains to buy a Motor Home. Another is going to renovate his two homes and buy two cars. This is good … very good.

- Everybody has a hot stock pick – Hot stock tips are not the subject of everyone’s conversations.

There are two things that concern us, though.

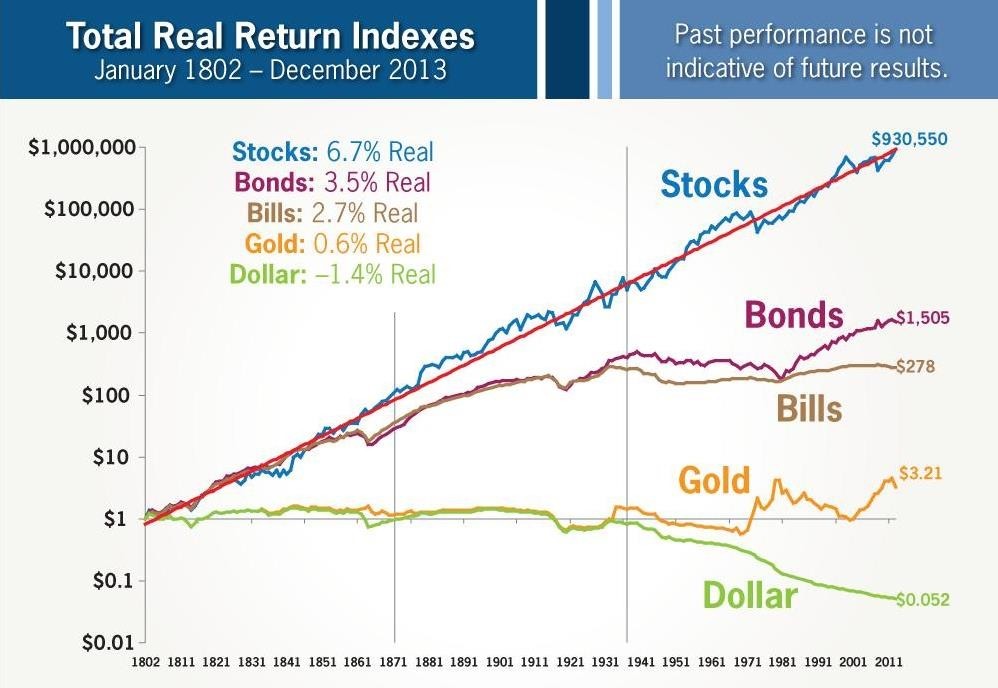

The first is the lack of volatility in the market. Normally, the S&P 500 will have a pullback of 14% (that is the average) during any given year. We haven’t had a significant pullback for 5 years. The chart below is a very long run view of the market. During the recession we got so far below the trend line that when the market turned in 2009 it had a head of steam that carried it upwards for 5 years to get back to the trend line. It was a straight run upwards to get back to the trend – no wavering, no volatility.

Now that we are back to the trend line, we expect that volatility will return. So we should expect a “normal” pullback of at least 14%. These pullbacks don’t need a reason to occur – they are just a part of investing. The last 5 years have been bereft of these pullbacks, so when a normal pullback does occur the media will play it up like it is the next great crash. It won’t be, but the media will create their own reality. The realities of the stock market have never made for good press, so the media emphasizes the negative and the short-term in order to capture your attention. This media misinformation will make it difficult to adhere to your long-term plan. We will be there to help you resist the siren call to do something, when staying the course is truly the best decision.

The second thing that concerns us is Europe. Today, Spain and Portugal, two economic basket cases, can borrow 10 year money cheaper than the USA. This is unheard of. The European central bank has driven rates down extremely low. But Europe, other than UK and Germany, is faring poorly. The fact that low rates haven’t spurred the European economies confirms to us that the European problem is structural, not interest rate related. Bad government, unions and labour legislation that prevent restructuring, and out dated equipment are keeping Europe mired in recession. They have problems that will take a generation or more to resolve. Europe represents 18% of the world’s economy, and if it is struggling it will be tougher for the world to keep on a growth tangent.

All genuinely functional adviser-client relationships are based on respect and trust: at moments of maximum uncertainty, you accept our advice because you trust us and you respect our experience and knowledge. Respect is a two-way street. We also respect our relationship and fully understand the significant role we play in your family’s current and future success.

We recommend that you continue to invest in accordance with your long-term target asset mix. This mix reflects your risk tolerance, investment goals and tax position, your retirement plan, and our long-term expectations for the market. Although our advice is to stay the course, we are not sitting idle. With the buoyant markets we have been harvesting the stocks that are in our sell zone (sold Tim Hortons after Burger King announced its takeover offer, sold Investors Group, sold Thomson Reuters) and redeploying the proceeds into the quality stocks that are in our buy zone.

Thank you for twenty years of trust and respect. We are honored to be your financial advisers, and look forward to a long future working together.

Your Team at Pacific Spirit

© Pacific Spirit Investment Management Inc., October, 2014. All rights reserved.