Dear Friends of Pacific Spirit,

We hope that you and your family are well after what has been an unprecedented and challenging year. We are writing to provide you with a brief overview of some key market developments over the last 12 months and provide some insights on what we can expect as we move through 2021.

The beginning of 2020 was dominated by the initial anxiety surrounding the outbreak of COVID-19, a new pandemic unlike anything we had seen in our lifetimes. To contain the outbreak, lockdowns became the norm around the world, with health and economic fears combining to punish capital markets with large declines. To help buffer their economies from the pandemic’s fallout governments and central banks took immediate measures, many of which continued throughout the year.

Both the Federal Reserve (the Fed) in the United States and the Bank of Canada lowered interest rates and indicated they would keep them low for a lengthy period of time. The Fed introduced quantitative easing measures, emergency lending and corporate bond and ETF purchases, while the Bank of Canada committed to buying at least $4 billion in Canadian government bonds each week. Canada also rolled out programs such as the Canada Emergency Response Benefit for those who had lost their jobs as a result of the virus, as well as the Canada Emergency Rent Subsidy, which provided up to 65% assistance for small businesses to pay rent. The European Central Bank announced hundreds of billions in stimulus, including bond purchases and cheap loans for banks.

These measures of support, combined with increasingly positive vaccine development (and ultimately vaccine rollout) news, led to a remarkable bounce back in the markets which began in the second quarter and continued throughout the rest of the year. The turnaround in the S&P 500 index began when the Federal Reserve clearly stated that it would do whatever was necessary to aid the economy. Even as the second wave of COVID-19 led to a resurgence of case numbers across the world, complete with renewed lockdown measures and increasing deaths, markets moved higher.

The S&P 500 Index, a broad measure of blue-chip U.S. equities, finished the year at a record high, up over 16%, while the Canadian S&P/TSX Composite Index gained 2.17% over the last 12 months. Government bonds declined due to the commitment from central banks to keep rates low for potentially years to come, with oil also finishing the year lower as economies struggled to find some sort of normalcy.

While there were many other interesting items in the news this year and particularly this past quarter, including the completion of a Brexit trade deal between Britain and the European Union (EU), geopolitical tensions between China and the U.S. and a presidential election, it would be impossible to argue that anything played a larger role in the fate of the markets than the covid outbreak and the subsequent response.

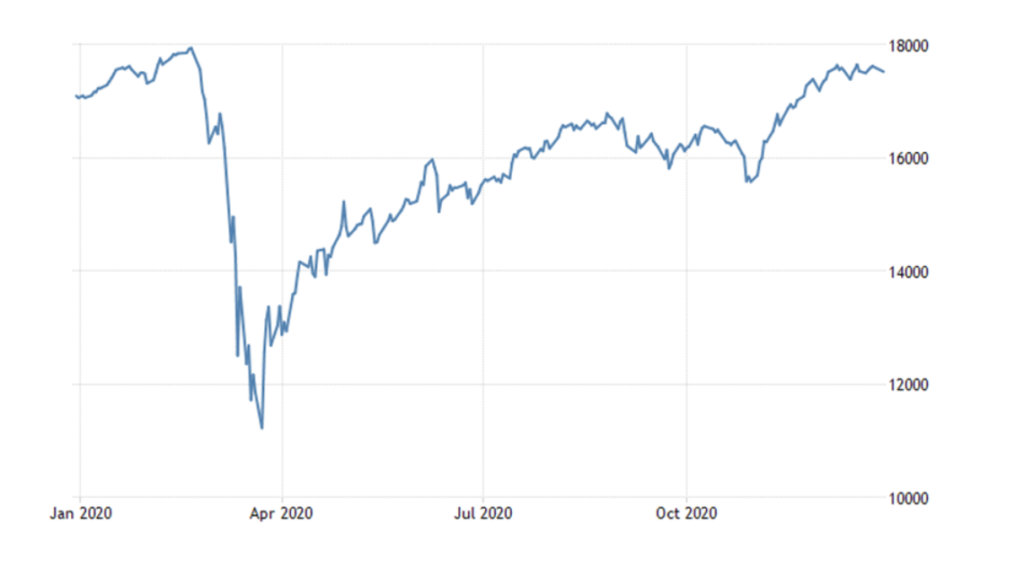

The S&P TSX chart below illustrates the Canadian equity market’s initial response to the virus’ spread and its subsequent recovery.

Source: Trading Economics

This recovery was a perfect demonstration of the importance of sticking to a long-term plan without allowing emotions to seep in. Had an investor decided to pull their money from the market on March’s downturn, their portfolio would likely have suffered for years to come.

That being said, at the time, there weren’t many investors calling for a move back to the highs of the year, never mind the all-time highs we saw in the U.S. indices. Many still have reservations about where markets go from here. Even with vaccines beginning to be distributed around the world, we are by no means finished with the virus or its economic ramifications. As one example, Canada’s most recent fiscal update included an announcement that the government had spent almost $500 billion on COVID-related support in 2020, and that the federal deficit could reach $400 billion by the end of the year. What’s more, the Canadian government plans to spend another $70-100 billion to stimulate the economy over the next three years. From an employment perspective, U.S. initial weekly jobless claims continue to hover around 800,000, and 9% of Canadians reported losing their jobs in 2020.

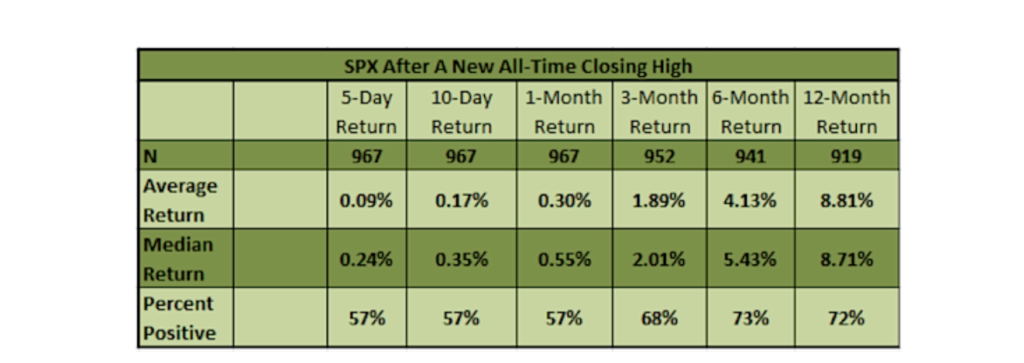

With all of this in mind, it can be difficult to avoid concern about what 2021 will bring, particularly as markets finished the year as strong as they did; that is why I have included some data below on how markets have reacted after hitting all-time highs. This table showcases how one index (the S&P 500) has historically performed in such situations, which we believe is especially pertinent considering that it again hit new highs this past week.

Source: See It Market

While this is obviously no prediction of how things will progress this time, particularly considering the unique year we’ve just experienced, it can still be helpful from an emotional perspective to view such data; this historical view provides a clearer outlook on things than could otherwise be afforded to us simply by watching daily news and market updates.

As interesting as 2020 was from a financial perspective, the news and data we received in Q4 makes it seem increasingly possible 2021 may prove even more so. For every worrisome report, there was a positive one to counter it. Despite Canada’s soaring deficit, credit ratings agency Moody’s reaffirmed Canada’s top credit rating of Aaa, citing their handling of the virus. While Fed Chairman Jerome Powell warned of a challenging next few months, he expects strong economic performance in the second quarter of 2021, and although Canada’s real gross domestic product (real GDP) is still 4% below where it was before the pandemic, it recently experienced its sixth straight month of growth. Finally, after extended bickering over the next U.S. COVID-19 relief bill, one was finally agreed to, with payments going out to Americans at year end.

Regardless of how the market chooses to react in the short term as we move through 2021, we learned this year that trying to predict its next move, regardless of how obvious it may seem, is a fool’s game. Rather, it is only by sticking to the long-term plan that we’ve built based on your specific financial goals that we can increase our probability of success in the long run.

In closing, we would like to wish you and your family well and remind you that we are always happy to discuss your investment plans. If you have any questions, please contact us at (604) 687-0123.

Sincerely,

PACIFIC SPIRIT INVESTMENT MANAGEMENT INC.